Business & Finance

Page Navigation

- Home

- Adopted Budgets

- Asset Management

- Check Registers

- Conflicts of Interest

- Debt

- Department Directory

- Financial Audits

- Financial Reports (Monthly)

- Financial Transparency

- FIRST Financial Integrity Rating

- Fundraising

- General Fund Revenues & Expenditures

- Payroll

- PEIMS

- Proposed Budget

- Purchasing

- Tax Information

- Travel

Tax Information

-

Waxahachie Independent School District adopted a tax rate that will raise more taxes for maintenance and operations than last year's tax rate. The tax rate will effectively be raised by 9.18% percent and will raise taxes for the maintenance and operations on a $100,000 home by approximately $91.80.

Tax Rate Trend

-

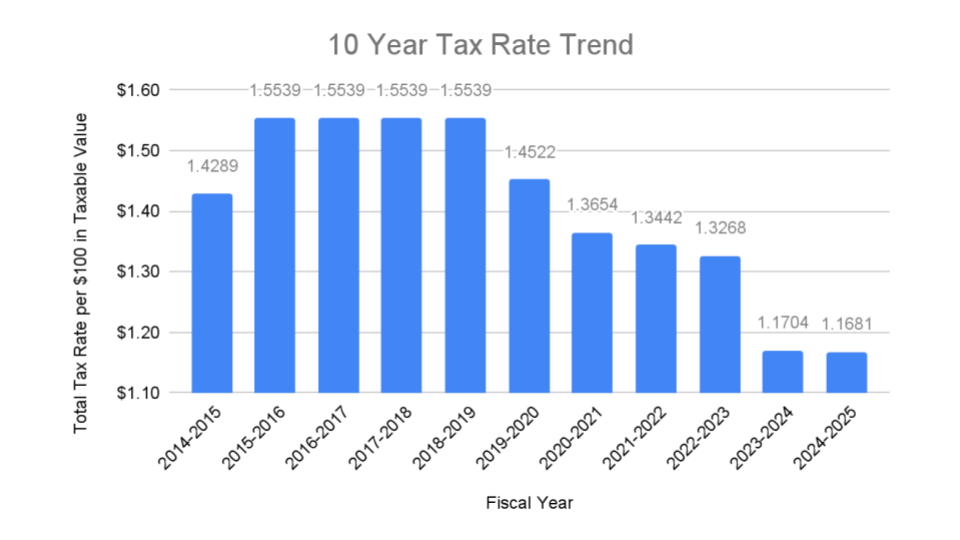

10 Year Tax Rate Trend

click image for text alternative

10-Year Tax Rate Trend

Total Tax Rate per $100 in taxable value per fiscal year

- 2014-15=$1.4289

- 2015-16=$1.5539

- 2016-17=$1.5539

- 2017-18=$1.5539

- 2018-19=$1.5539

- 2019-20=$1.4522

- 2020-21=$1.3654

- 2021-22=$1.3442

- 2022-23=$1.3268

- 2023-24=$1.1704

- 2024-25=$1.1681

Our Commitment

-

Waxahachie ISD is committed to providing the highest quality education to the students in our district. Furthermore, the district is also committed to honoring and supporting our staff through competitive compensation and benefits packages. Through sound fiscal management, the Board of Trustees has diligently worked to lower the overall property tax rate with funds provided by the Texas Legislature. Additionally, homeowners saw the homestead exemption more than double in value, from $40,000 to $100,000 in 2023, further providing property tax relief. Property taxes owed on a residence with a valid homestead exemption in 2018-2019, valued at $200,000 would have been $2,486.24. The same residence with a valid homestead exemption in 2024-2025 would owe property taxes of $1,168.10 – a 53% reduction in property taxes.